Some seem confused about what the Occupy Wall Street protests are about, protesters have been called un-American, free-loaders, uninformed, and worse. Many in politics and the media claim that they don't know what the protesters even want and question whether the protesters even know what they're protesting about.

The point of the protest is fairly simple and I assumed readily apparent and I think it's best illustrated by a failed Senate resolution that was highlighted on MSNBC's "The Last Word with Lawrence O'Donnell" tonight. While Mr. O'Donnell didn't make a correlation between the failed resolution and the protest I feel that it demonstrates what folks are upset about.

Senate Resolution 1323 is a simple one-page document that highlights a few facts and makes a statement about fairness. The resolution notes who has been winning over the past few decades and who has been losing over those same decades. All the resolution asks is that those who have been winning for so long contribute some to our debt reduction effort, it doesn't even go so far as to give an amount, all it does is say that it would be fair that those who have not been asked to contribute anything to our debt contribute something. Unfortunately this resolution failed and did not garner a single Republican vote.

Those who made up the top 1% of income earners in this country prior to the recession have been doing even better over the past couple of years than they were prior to the recession. Most in the top 1% pay a lower tax rate than the average American in the form of capital gains. And some of those in the top 1% were the very ones who caused our current financial predicament, and they still have their jobs and they haven't been asked to contribute anything to our recovery.

Those participating in Occupy Wall Street are representing the other 99% of the Americans, many of them prior to the recession had good paying jobs, paid their bills, and weren't drowning in their mortgage. They were doing exactly what was expected of them and were model citizens. Then suddenly in 2008 or 2009 they found themselves jobless due to the greed and illegal dealings of others and even though many of those business have since recovered they've now found they can make more money with less and are not hiring all of those jobs back. All debt reduction plans that have passed and those that actually have a chance of passing Congress only ask that those from the 99% who have already been wronged and are already struggling be the ones to give up more in the name of debt reduction. All the protesters want is for the top 1% to have to contribute just a little bit to our recovery (as do many of the 1%) and that maybe, just maybe, those who broke laws and caused our current economic situation actually face justice for their actions instead of collecting their record bonuses.

Is that really so hard to understand? I encourage you to read the Senate resolution, it's only one page and the statistics given couldn't be clearer. You can read it here.

Monday, October 10, 2011

Saturday, August 13, 2011

The Petition

If you have any millionaire or billionaire friends you can have them sign the petition I've started for my plan via the petition tool on the left-hand side of this page or at the following link:

http://www.change.org/petitions/us-house-of-representatives-us-senate-2-tax-increase-on-income-of-1-million-and-above-for-10-years

Thanks for reading!

http://www.change.org/petitions/us-house-of-representatives-us-senate-2-tax-increase-on-income-of-1-million-and-above-for-10-years

Thanks for reading!

The Plan

Okay so it's 2:00am as I'm writing this and for some reason I can't sleep, but as I was laying in bed an idea hit me so bear with me as I'm going to try an articulate this idea and put it in writing before I fall asleep and forget it. It's going to sound a little crazy but I think it's just crazy enough to work and will solve or at least improve our current economic outlook, and it will garner bipartisan support even from those who have pledged to never raise taxes.

Allow me to preface my idea with a little background information. We never paid for the Bush tax cuts, for some reason we decided to lower everyone's taxes and not actually pay for them and never thought to roll them back even though we were involved in two wars. As far as I'm aware we've never lowered taxes during war in our nation's history, nor waged a war without paying for it. It was fiscally irresponsible for us to have lowered taxes when we did and nobody who voted for them can claim to be a "fiscal conservative." We've chosen to extend these tax cuts and still not provide a way to pay for them. Obviously we can't just roll back the tax cuts on everybody, rolling back cuts on the middle-class or "spending-class" would be disastrous and shrink our already slow-growing economy and increase unemployment. The only segment of our population that is doing well at this point are our wealthiest Americans and they are statistically doing better than before the recession, they are currently not sacrificing in this economy as the other 99% of us are and as we are being asked to further sacrifice through spending cuts. Nor have we been asked to sacrifice as a citizenry during these wars as we have in wars past. I cannot imagine what those who lived through WWII endured when everything was being rationed, how disappointed they must be in us today. Only 1% of our citizens are actually enlisted in military service, an all-volunteer force we can certainly be proud of. But what did the other 99% of the population contribute to the war effort? Obviously parents, spouses, and others sacrificed hours of worry as loved ones served overseas and many families paid the ultimate sacrifice when their heroes made the return trip in flag-draped caskets. But what was asked of us as a nation really? We got tax cuts and didn't have to ration a single thing.

It's now time for our nation to ask those who are doing well to sacrifice for the betterment of their country and their fellow Americans, and it's time for them to answer that call and that brings me to my plan.

The Policy Proposal

My proposal is to raise the tax rate on individuals making $1 million per year in income by 2% for a period of 10 years. The additional revenue generated from this tax increase must be used directly for investments that will lead to job creation and economic growth.

My intention is not to demonize millionaires or billionaires, there is certainly nothing wrong with making $1 million a year or more and the tax increase is not a form of "punishment." But our economy is in need of a boost, economists of all political stripes agree that we need to increase revenues even former Reagan and Bush advisers and as I mentioned earlier the wealthiest of Americans are the only group that can absorb a tax increase at the moment. I don't think of this as a punishment for being rich but as a request for them to serve their country in a time of need. For some this may be the first time they have been asked to serve and others may have already served on the battlefield or at home, but if our men and women in uniform can deploy 6 or 8 times to a war zone some of those who have served before can serve again for us financially.

The current top tax rate is 35%, let's say for argument's sake that somebody making $1 million dollars actually pays the full rate (nobody pays a the full tax rate and any income level) that leaves them with $650,000. Divide that over 12 months and that's a monthly after-tax income of $54,167. Someone at this income level is probably not living paycheck to paycheck and could easily absorb an additional 2% in taxes, under the temporary 10 year increase I'm proposing that changes our figures to $630,000 annually at $52,500 per month.

Now let's use some real numbers because as I stated before nobody pays the full tax rate. According to Tax.com in 2007 the average effective tax rate for somebody making $1 million was 22.1% (and that figure has been trending down over time). If we raise their tax rate from 35% to 37% as I propose they'll probably only have an effective tax increase of less than 1%, but for easy math let's say they get an effective increase of 1%. In more realistic numbers they will take home $769,000 annually which is $64,083 per month. One would think that this wouldn't be much of a burden.

Winning Bipartisan Support

Now you may be saying to yourself, "Chris you're delusional you'll never get the GOP to go for a tax increase." If you watched the GOP presidential debate Thursday night you'd be right in thinking that, even with a deal of 10:1 spending cuts to revenue increases none of the candidates would sign that deal. As we saw in the debt ceiling debate tax increases, or even eliminating some egregious tax loopholes, was a non-starter for conservatives. But I'm putting my faith into those whose taxes will be increased.

The next part of my plan is to start a petition that will be signed by millionaires and billionaires urging congress to pass a 2% tax increase on them in which the new revenues will be invested in jobs and economic growth. I don't feel that this will be a tough sell on those who will have their taxes increased, many prominent millionaires and billionaires have asked to have their taxes increased and have stated that they didn't ask for the Bush tax cuts in the first place. There's even a group called "Patriotic Millionaires for Fiscal Responsibility" who had petitioned the President in 2010 to allow the Bush tax cuts to expire for households making over $250,000 annually. But we don't need to convince President Obama, he's already on board with raising revenue, we have to target our petition at Congress.

Once we have gathered a few million signatures from our millionaires and billionaires we can send them to the desk of any member of Congress who has vowed to not raise taxes along with a copy of the proposed legislation. Once they know that those who the tax increase is aimed at see it as their patriotic duty to have their taxes temporarily raised and add in that any spending stemming from these tax revenues won't be "increased spending" as these revenues didn't previously exist I think they will have no argument against passing this temporary tax increase.

The First Step

So there's the plan, I think this is something that reasonable people can agree on moving forward with and voting for. Now is the time to take action, I will spend the next few weeks petitioning the White House and members of Congress to bring this proposal forward and start crunching the numbers. I will explore the process of getting a petition started and send it to every activist group and news outlet in every corner of the country and hope it catches on like wildfire. I don't know how something becomes "viral" but everyone whose ever had anything go viral says they never expected it to, I hope this is something we can get done so we can begin to tackle our unemployment crisis and get Americans who are struggling back on their feet again.

It's now 3:00am, I think I caught all my typos but if not it's early so give me a beak! That's my excuse anyway.

Allow me to preface my idea with a little background information. We never paid for the Bush tax cuts, for some reason we decided to lower everyone's taxes and not actually pay for them and never thought to roll them back even though we were involved in two wars. As far as I'm aware we've never lowered taxes during war in our nation's history, nor waged a war without paying for it. It was fiscally irresponsible for us to have lowered taxes when we did and nobody who voted for them can claim to be a "fiscal conservative." We've chosen to extend these tax cuts and still not provide a way to pay for them. Obviously we can't just roll back the tax cuts on everybody, rolling back cuts on the middle-class or "spending-class" would be disastrous and shrink our already slow-growing economy and increase unemployment. The only segment of our population that is doing well at this point are our wealthiest Americans and they are statistically doing better than before the recession, they are currently not sacrificing in this economy as the other 99% of us are and as we are being asked to further sacrifice through spending cuts. Nor have we been asked to sacrifice as a citizenry during these wars as we have in wars past. I cannot imagine what those who lived through WWII endured when everything was being rationed, how disappointed they must be in us today. Only 1% of our citizens are actually enlisted in military service, an all-volunteer force we can certainly be proud of. But what did the other 99% of the population contribute to the war effort? Obviously parents, spouses, and others sacrificed hours of worry as loved ones served overseas and many families paid the ultimate sacrifice when their heroes made the return trip in flag-draped caskets. But what was asked of us as a nation really? We got tax cuts and didn't have to ration a single thing.

It's now time for our nation to ask those who are doing well to sacrifice for the betterment of their country and their fellow Americans, and it's time for them to answer that call and that brings me to my plan.

The Policy Proposal

My proposal is to raise the tax rate on individuals making $1 million per year in income by 2% for a period of 10 years. The additional revenue generated from this tax increase must be used directly for investments that will lead to job creation and economic growth.

My intention is not to demonize millionaires or billionaires, there is certainly nothing wrong with making $1 million a year or more and the tax increase is not a form of "punishment." But our economy is in need of a boost, economists of all political stripes agree that we need to increase revenues even former Reagan and Bush advisers and as I mentioned earlier the wealthiest of Americans are the only group that can absorb a tax increase at the moment. I don't think of this as a punishment for being rich but as a request for them to serve their country in a time of need. For some this may be the first time they have been asked to serve and others may have already served on the battlefield or at home, but if our men and women in uniform can deploy 6 or 8 times to a war zone some of those who have served before can serve again for us financially.

The current top tax rate is 35%, let's say for argument's sake that somebody making $1 million dollars actually pays the full rate (nobody pays a the full tax rate and any income level) that leaves them with $650,000. Divide that over 12 months and that's a monthly after-tax income of $54,167. Someone at this income level is probably not living paycheck to paycheck and could easily absorb an additional 2% in taxes, under the temporary 10 year increase I'm proposing that changes our figures to $630,000 annually at $52,500 per month.

Now let's use some real numbers because as I stated before nobody pays the full tax rate. According to Tax.com in 2007 the average effective tax rate for somebody making $1 million was 22.1% (and that figure has been trending down over time). If we raise their tax rate from 35% to 37% as I propose they'll probably only have an effective tax increase of less than 1%, but for easy math let's say they get an effective increase of 1%. In more realistic numbers they will take home $769,000 annually which is $64,083 per month. One would think that this wouldn't be much of a burden.

Winning Bipartisan Support

Now you may be saying to yourself, "Chris you're delusional you'll never get the GOP to go for a tax increase." If you watched the GOP presidential debate Thursday night you'd be right in thinking that, even with a deal of 10:1 spending cuts to revenue increases none of the candidates would sign that deal. As we saw in the debt ceiling debate tax increases, or even eliminating some egregious tax loopholes, was a non-starter for conservatives. But I'm putting my faith into those whose taxes will be increased.

The next part of my plan is to start a petition that will be signed by millionaires and billionaires urging congress to pass a 2% tax increase on them in which the new revenues will be invested in jobs and economic growth. I don't feel that this will be a tough sell on those who will have their taxes increased, many prominent millionaires and billionaires have asked to have their taxes increased and have stated that they didn't ask for the Bush tax cuts in the first place. There's even a group called "Patriotic Millionaires for Fiscal Responsibility" who had petitioned the President in 2010 to allow the Bush tax cuts to expire for households making over $250,000 annually. But we don't need to convince President Obama, he's already on board with raising revenue, we have to target our petition at Congress.

Once we have gathered a few million signatures from our millionaires and billionaires we can send them to the desk of any member of Congress who has vowed to not raise taxes along with a copy of the proposed legislation. Once they know that those who the tax increase is aimed at see it as their patriotic duty to have their taxes temporarily raised and add in that any spending stemming from these tax revenues won't be "increased spending" as these revenues didn't previously exist I think they will have no argument against passing this temporary tax increase.

The First Step

So there's the plan, I think this is something that reasonable people can agree on moving forward with and voting for. Now is the time to take action, I will spend the next few weeks petitioning the White House and members of Congress to bring this proposal forward and start crunching the numbers. I will explore the process of getting a petition started and send it to every activist group and news outlet in every corner of the country and hope it catches on like wildfire. I don't know how something becomes "viral" but everyone whose ever had anything go viral says they never expected it to, I hope this is something we can get done so we can begin to tackle our unemployment crisis and get Americans who are struggling back on their feet again.

It's now 3:00am, I think I caught all my typos but if not it's early so give me a beak! That's my excuse anyway.

Wednesday, August 10, 2011

We Need A Stimulus: Follow-Up

I have been inspired to provide a quick follow-up to yesterday's blog entry We Need A Stimulus. One of the stories on tonight's episode of MSNBC's The Rachel Maddow Show was the hypocrisy of those in the GOP who decry government spending to spur job growth. More specifically she went after Republicans that publicly rail against the stimulus while privately requesting stimulus funds from the Obama administration and admitting that requested funds will create jobs. Rachel provided a link to a previous episode that covered this topic along with other articles that point out this hypocrisy citing specific examples.

The first link is from an article I read this morning written by Sam Stein for the Huffington post. Anybody whose heard of GOP Presidential candidate Michele Bachmann probably know that she's very open in her disdain for government and government spending. Anti-government spending is one of the major pillars of her campaign but Mr. Stein did a little research and found several letters she had written in 2009 requesting government stimulus funds for her district and in those letters she lists how many jobs those stimulus funds will create:

The first link is from an article I read this morning written by Sam Stein for the Huffington post. Anybody whose heard of GOP Presidential candidate Michele Bachmann probably know that she's very open in her disdain for government and government spending. Anti-government spending is one of the major pillars of her campaign but Mr. Stein did a little research and found several letters she had written in 2009 requesting government stimulus funds for her district and in those letters she lists how many jobs those stimulus funds will create:

Another article that was not available on her website was written by Steve Benen of Washington Monthly who was a guest on tonight's show. He has a proposal for the President and one I think could be a very effective stimulus:

You can read his full article here:"Here's the pitch: have the White House take the several hundred letters GOP lawmakers have sent to the executive branch since 2009, asking for public investments, and let President Obama announce he'll gladly fund all of the Repulicans' requests that have not yet been filled."

The next article is by Lee Fang of Think Progress illustrating how 110 GOP lawmakers who voted against the stimulus tout its success and ask for more funds for their districts:

And the final link is to a video segment from a previous The Rachel Maddow Show episode that listed lawmakers who voted against the stimulus but praised stimulus programs and asked for more funds (I'm not sure of the original air date):

As I eluded to yesterday, targeted government spending to programs that create jobs and grow the economy has always been a bipartisan issue. Presidents from both parties have enacted these types of stimulus measures. The same bipartisan support holds true today, the difference is that some GOP politicians vote against the stimulus and pretend not to support it directly but then take photo-ops once the money creates jobs in their districts and secretly write letters requesting more. It's time for these legislators to come out of the stimulus closet and openly propose a job-creating stimulus. We need to create jobs now.

Tuesday, August 9, 2011

We Need A Stimulus

Okay so its been a little over a month since I've posted anything, chalk it up to a busy work schedule combined with some writer's block. The only thing that seems worth writing about politically recently has been revolving around the debt ceiling and the economy and I've been pretty bored (although still aggravated) with that topic. As you know Congress has recently passed a debt reduction package that only contains spending cuts, to the chagrin of liberals, and in turn raises the debt ceiling, to the disfavor of the Tea Party. Standard & Poor's downgraded the creditworthiness of the United States for the first time in American history on Friday from AAA to AA+. The downgrade was strictly political pointing out that some in Congress were ready and willing to take the US to the brink of default and that Republicans were unwilling to increase revenues even if that meant only cutting tax loopholes while not raising tax rates (not sure why they waited until after the deal was done to downgrade). Republicans in Congress and those seeking the GOP nomination for a run at the White House have ignored that little factoid while placing all of the blame on the President. Although S&P is correct in their statements about our current political turmoil they were wrong for downgrading our creditworthiness as there is no current risk of us not honoring our debts. In fact investors flocked to US Treasury notes on Monday, ignoring S&P's downgrade and proving that the US is the safest investment in the world, all while the Dow plunged 634 points in response to investor's concerns that the economy is not growing as fast as needed. Washington has spent the past few months focusing on the wrong problems, deficit and our long-term debt, and what they should be focusing on is economic growth and investors agree which is why the Dow had fallen by 15% over the past two weeks. What we need now is a stimulus.

Moving in the Wrong Direction; a Brief History Lesson

We're making the same mistakes some previous administrations had made during times of recession and depression which lengthened the time that many had to endure economic suffering. I'm reminded of the often misquoted and misattributed statement of George Santayana who said "those who cannot remember the past are condemned to repeat it." While there has been an influx of freshmen members of congress who claim to know more of American history than the average American they clearly did not study the economics of recession. After the stock market crash of 1929 that led to the Great Depression President Herbert Hoover chose to focus on balancing the budget (having already created deficits in part by reducing the top tax rate from 73% to 24% prior to the crash), rejecting the idea of federal relief payments to individuals, and passing legislation to expel immigrants from Mexico back to their home country. These are many of the same ideas being proposed today; lower taxes on the wealthiest and corporations, reduce unemployment insurance benefits, entitlements, and other government assistance programs, and increase the deportation of illegal immigrants with tougher anti-immigration measures. As we now know none of Hoover's initiatives led to economic recovery and only worsened a bad situation.

When Franklin D. Roosevelt took office in 1933 he immediately went to work on initiatives to grow the economy. The creation of the Civilian Conservation Corps allowed the government to directly hire 250,000 men to work on rural projects, he implemented mortgage relief to stop many foreclosures and keep people in their homes (although President Hoover also enacted a mortgage relief policy it was too little and too late into his presidency to make any significant impact). FDR enacted tougher regulations on business while also encouraging unions and creation of the Securities Exchange Commission, the Tennessee Valley Authority (infrastructure projects), and Social Security. He injected billions of dollars into the economy as stimulus and while Hoover grew the debt from 16% of the gross national product (GNP) to 40% the debt held steady under FDR until the start of WWII, but he still was blamed for the height debt by conservative opponents (sound familiar?). Unemployment fell at a steady rate during this period and the economy grew rapidly until 1937.

Enter 1937, company profits were at the levels they were in 1929 and unemployment, while high, was declining (remember company profits now are better than they were in 2008 and unemployment is slowly declining) and the FDR administration felt pressured into addressing the debt and deficit. In response government spending was reduced and the economy dipped into a 13 month recession with unemployment rising by over 4% and manufacturing output declined by 37%

There should be a lesson to be learned from this, worrying about debt and deficits during a recession and responding by tightening the government's belt leads to an extended recession or a decline back into a recession during a recovery. What grew the economy during the 1930's and other times in our history was economic stimulus and investments in pro-growth agendas. President Bush lowered taxes on the wealthiest of Americans prior to our recession that started in 2008 (just like Hoover did before the depression) and President Obama has chosen to listen to conservatives and extend these tax cuts, keeping money from the government that could be used to stimulate our economy and address our deficits. And now the President has agreed to reign in government spending by reducing proposed spending in the FY 2011 budget and a cuts-only agreement to address our nation's debt during a time of slow economic recovery. I don't feel that enacting the same policies that led to recessions in the past will somehow not have the same results now.

A Road to Recovery

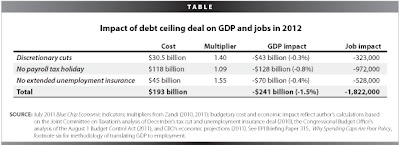

The first item on the agenda is to extend unemployment benefits, current policies that extend federal unemployment benefits are set to expire at the end of 2011, we can't let these expire. Unfortunately there are some that demonize the unemployed, many of those who are currently collecting unemployment insurance are only unemployed as a result of the recession. Prior to our current economic situation many of these individuals held stable, well-paying jobs, and have been actively seeking employment. Companies like McDonald's aren't going to take a chance on an unemployed high-level corporate manager who used to make six figures knowing that they will take a better job in their previous field as soon as one becomes available. According to the Joint Committee on Taxation not extending unemployment benefits would cost 528,000 jobs and shrink the GDP by 0.4% in 2012 (see Table 1). Unemployment provides a safety net for families so that they can continue to buy food, pay their bills, and stay in their home while the wage earner(s) are looking for employment.

Next we need to extend the payroll tax holiday that is also set to expire at the end of this year. I was initially against the payroll tax holiday, and still am, as I feel it was a ploy to underfund Social Security which currently does not contribute to our debt and felt that it was a slippery slope. Once payroll taxes were lowered what politician in their right mind would ever raise them back to their normal rates? But now that payroll taxes have been lowered allowing the holiday to expire would essentially raise taxes on the middle class who are already suffering, prompting them to spend less and we just cant afford to take dollars out of the economy right now. According to the Joint Committee on Taxation not extending the payroll tax holiday would cost 972,000 jobs and shrink the GDP by 0.8% in 2012 (see Table 1).

If you combine not extending unemployment and the payroll tax holiday with the jobs that will be lost due to spending cuts proposed by the debt reduction deal the economy will lose over 1.8 million jobs in 2012 along with shrinking the GDP by 1.5% (see Table 1). This is not a formula for recovery.

Table 1.

We also must invest in education, the current trend among states and the federal government has been to slash funding for education. I'm speaking of both primary and secondary education. We must invest in our children to ensure that we remain competitive on the world stage and to have a workforce who posses the skills needed for the 21st century and beyond. There are a lot of those unemployed I mentioned earlier whose jobs will never return, either their employer learned to do more with less or their job was shipped overseas with wages so low the United States cannot compete. We must invest in education for the unemployed as well to provide them with the tools needed to transition to a new career. Eric Spiegel, CEO for Siemens in the US has expressed that they have jobs that need to be filled but the pool of unemployed lack the skills necessary for those job openings (read the CNBC story here).

And finally we need to invest in job-creation projects and I feel the most effective way the government can directly create jobs is through infrastructure projects. In 2009 the American Society of Civil Engineers released their Report Card for American Infrastructure giving the US an overall rating of "D" and estimating it would cost $2.2 trillion over 5 years to fix our deficiencies. We know we have to fix our infrastructure, not doing so is just delaying the inevitable. The government will have to spend money at some point to fix our infrastructure and there's no better time than now. It's the perfect storm, you have an unemployment rate of 9.1%, construction companies, manufactures, and contractors are desperate for work. The US government will not be able to get work contracts any cheaper than they can right now, if we wait until the economy is stronger to invest in infrastructure the price will just go up, labor, materials, and overhead will all cost more in a stronger economy. Not only will the government get cheaper contracts now rather than later it will create direct jobs for those who will be working on these projects, these construction and manufacturing jobs will in turn create retail and service jobs, adding more taxpayers to the pool which in turn could be used to address our debt once the economy recovers. It's a win-win.

We can roll all of these initiatives into a stimulus package that will guarantee economic growth at a much faster pace than we are experiencing now. I know that "stimulus" has become a bad word in our lexicon and many have said that the stimulus "failed" and didn't save or create any jobs. This is just not true, if anything the stimulus wasn't big enough and was more of a band-aid approach. The stimulus provided money to states who were out of money to prevent massive layoffs in the public sector, had the stimulus not been passed millions of teachers, firefighters, police officers, and other public sector workers would have been out of work which would have increased unemployment to even higher rates than we are currently experiencing and would have led to more job losses in the private sector as spending would have decreased. Had more money been allotted for the stimulus not only could it have saved the jobs it did there would have been more money available to invest in projects that would have created new jobs (some states were able to invest in infrastructure projects that did lead to job creation). According to FactCheck.org (using numbers from the Congressional Budget Office) the stimulus created and saved between 1.4 million and 3.3 million jobs and reduced unemployment between 0.7 and 1.8 percentage points. The band-aid stimulus has since expired, now it's time to enact the pro-growth stimulus including items listed above.

A Choice

Some claim that just reducing taxes on corporations and the wealthy along with spending cuts will spur job growth, it doesn't. We've tried supply-side economics in the past and it doesn't lead to job creation. The Bush tax cuts were in place for 10 years without any significant job growth, we have since extended the cuts and have not seen a sudden jump in job growth that currently isn't keeping pace with population growth. Companies can't hire more employees if they can't sell any more of their services or products, the economy now needs demand to create growth, the supply-side math just doesn't add up.

Others claim that getting our fiscal house in order should be our primary objective and somehow (it hasn't been explained how as far as I'm aware) this will spur hiring and economic growth. As we've learned from the lessons of Hoover and FDR cutting spending during a recession/recovery actually shrinks the economy and causes unemployment to rise.

Economic recovery is going to cost money, Presidents from both parties have invested dollars in infrastructure and other programs during recessions and we know it creates jobs and spurs economic growth. Now that doesn't mean that we can haphazardly spend, we have to target stimulus injections towards programs we know promotes growth such as those I've already listed. Anytime I bring this topic up I'm chided by my conservative friends about out-of-control spending, I don't know of a single liberal out there who thinks we should spend beyond our means for extended periods of time or during a strong economic climate. But in desperate times you sometimes have to overextend your finances to keep a bad situation from getting worse. I cannot understand in a world where it is expected that businesses and individuals will carry debt (most folks don't pay cash for their home) that somehow the government can't. Every major country in the world has debt, why would the United States by any different? Everyone agrees that we cannot sustain our current spending levels, yes even liberals, but it all comes down to priorities. Do you focus on debt now while the economy and country are hurting or do you invest in growth now and then focus on spending once the economy recovers?

In which order do you think we should address the following?

__ Getting the unemployed back to work

__ Paying down our debt

I like to think of it in terms of a household, if you're out of work do you focus on paying off your credit cards or focus on getting a new job even if it means spending money on a new suit and a resume? I think the choice is obvious, somehow Washington does not.

Moving in the Wrong Direction; a Brief History Lesson

We're making the same mistakes some previous administrations had made during times of recession and depression which lengthened the time that many had to endure economic suffering. I'm reminded of the often misquoted and misattributed statement of George Santayana who said "those who cannot remember the past are condemned to repeat it." While there has been an influx of freshmen members of congress who claim to know more of American history than the average American they clearly did not study the economics of recession. After the stock market crash of 1929 that led to the Great Depression President Herbert Hoover chose to focus on balancing the budget (having already created deficits in part by reducing the top tax rate from 73% to 24% prior to the crash), rejecting the idea of federal relief payments to individuals, and passing legislation to expel immigrants from Mexico back to their home country. These are many of the same ideas being proposed today; lower taxes on the wealthiest and corporations, reduce unemployment insurance benefits, entitlements, and other government assistance programs, and increase the deportation of illegal immigrants with tougher anti-immigration measures. As we now know none of Hoover's initiatives led to economic recovery and only worsened a bad situation.

When Franklin D. Roosevelt took office in 1933 he immediately went to work on initiatives to grow the economy. The creation of the Civilian Conservation Corps allowed the government to directly hire 250,000 men to work on rural projects, he implemented mortgage relief to stop many foreclosures and keep people in their homes (although President Hoover also enacted a mortgage relief policy it was too little and too late into his presidency to make any significant impact). FDR enacted tougher regulations on business while also encouraging unions and creation of the Securities Exchange Commission, the Tennessee Valley Authority (infrastructure projects), and Social Security. He injected billions of dollars into the economy as stimulus and while Hoover grew the debt from 16% of the gross national product (GNP) to 40% the debt held steady under FDR until the start of WWII, but he still was blamed for the height debt by conservative opponents (sound familiar?). Unemployment fell at a steady rate during this period and the economy grew rapidly until 1937.

Enter 1937, company profits were at the levels they were in 1929 and unemployment, while high, was declining (remember company profits now are better than they were in 2008 and unemployment is slowly declining) and the FDR administration felt pressured into addressing the debt and deficit. In response government spending was reduced and the economy dipped into a 13 month recession with unemployment rising by over 4% and manufacturing output declined by 37%

There should be a lesson to be learned from this, worrying about debt and deficits during a recession and responding by tightening the government's belt leads to an extended recession or a decline back into a recession during a recovery. What grew the economy during the 1930's and other times in our history was economic stimulus and investments in pro-growth agendas. President Bush lowered taxes on the wealthiest of Americans prior to our recession that started in 2008 (just like Hoover did before the depression) and President Obama has chosen to listen to conservatives and extend these tax cuts, keeping money from the government that could be used to stimulate our economy and address our deficits. And now the President has agreed to reign in government spending by reducing proposed spending in the FY 2011 budget and a cuts-only agreement to address our nation's debt during a time of slow economic recovery. I don't feel that enacting the same policies that led to recessions in the past will somehow not have the same results now.

A Road to Recovery

The first item on the agenda is to extend unemployment benefits, current policies that extend federal unemployment benefits are set to expire at the end of 2011, we can't let these expire. Unfortunately there are some that demonize the unemployed, many of those who are currently collecting unemployment insurance are only unemployed as a result of the recession. Prior to our current economic situation many of these individuals held stable, well-paying jobs, and have been actively seeking employment. Companies like McDonald's aren't going to take a chance on an unemployed high-level corporate manager who used to make six figures knowing that they will take a better job in their previous field as soon as one becomes available. According to the Joint Committee on Taxation not extending unemployment benefits would cost 528,000 jobs and shrink the GDP by 0.4% in 2012 (see Table 1). Unemployment provides a safety net for families so that they can continue to buy food, pay their bills, and stay in their home while the wage earner(s) are looking for employment.

Next we need to extend the payroll tax holiday that is also set to expire at the end of this year. I was initially against the payroll tax holiday, and still am, as I feel it was a ploy to underfund Social Security which currently does not contribute to our debt and felt that it was a slippery slope. Once payroll taxes were lowered what politician in their right mind would ever raise them back to their normal rates? But now that payroll taxes have been lowered allowing the holiday to expire would essentially raise taxes on the middle class who are already suffering, prompting them to spend less and we just cant afford to take dollars out of the economy right now. According to the Joint Committee on Taxation not extending the payroll tax holiday would cost 972,000 jobs and shrink the GDP by 0.8% in 2012 (see Table 1).

If you combine not extending unemployment and the payroll tax holiday with the jobs that will be lost due to spending cuts proposed by the debt reduction deal the economy will lose over 1.8 million jobs in 2012 along with shrinking the GDP by 1.5% (see Table 1). This is not a formula for recovery.

Table 1.

We also must invest in education, the current trend among states and the federal government has been to slash funding for education. I'm speaking of both primary and secondary education. We must invest in our children to ensure that we remain competitive on the world stage and to have a workforce who posses the skills needed for the 21st century and beyond. There are a lot of those unemployed I mentioned earlier whose jobs will never return, either their employer learned to do more with less or their job was shipped overseas with wages so low the United States cannot compete. We must invest in education for the unemployed as well to provide them with the tools needed to transition to a new career. Eric Spiegel, CEO for Siemens in the US has expressed that they have jobs that need to be filled but the pool of unemployed lack the skills necessary for those job openings (read the CNBC story here).

And finally we need to invest in job-creation projects and I feel the most effective way the government can directly create jobs is through infrastructure projects. In 2009 the American Society of Civil Engineers released their Report Card for American Infrastructure giving the US an overall rating of "D" and estimating it would cost $2.2 trillion over 5 years to fix our deficiencies. We know we have to fix our infrastructure, not doing so is just delaying the inevitable. The government will have to spend money at some point to fix our infrastructure and there's no better time than now. It's the perfect storm, you have an unemployment rate of 9.1%, construction companies, manufactures, and contractors are desperate for work. The US government will not be able to get work contracts any cheaper than they can right now, if we wait until the economy is stronger to invest in infrastructure the price will just go up, labor, materials, and overhead will all cost more in a stronger economy. Not only will the government get cheaper contracts now rather than later it will create direct jobs for those who will be working on these projects, these construction and manufacturing jobs will in turn create retail and service jobs, adding more taxpayers to the pool which in turn could be used to address our debt once the economy recovers. It's a win-win.

We can roll all of these initiatives into a stimulus package that will guarantee economic growth at a much faster pace than we are experiencing now. I know that "stimulus" has become a bad word in our lexicon and many have said that the stimulus "failed" and didn't save or create any jobs. This is just not true, if anything the stimulus wasn't big enough and was more of a band-aid approach. The stimulus provided money to states who were out of money to prevent massive layoffs in the public sector, had the stimulus not been passed millions of teachers, firefighters, police officers, and other public sector workers would have been out of work which would have increased unemployment to even higher rates than we are currently experiencing and would have led to more job losses in the private sector as spending would have decreased. Had more money been allotted for the stimulus not only could it have saved the jobs it did there would have been more money available to invest in projects that would have created new jobs (some states were able to invest in infrastructure projects that did lead to job creation). According to FactCheck.org (using numbers from the Congressional Budget Office) the stimulus created and saved between 1.4 million and 3.3 million jobs and reduced unemployment between 0.7 and 1.8 percentage points. The band-aid stimulus has since expired, now it's time to enact the pro-growth stimulus including items listed above.

A Choice

Some claim that just reducing taxes on corporations and the wealthy along with spending cuts will spur job growth, it doesn't. We've tried supply-side economics in the past and it doesn't lead to job creation. The Bush tax cuts were in place for 10 years without any significant job growth, we have since extended the cuts and have not seen a sudden jump in job growth that currently isn't keeping pace with population growth. Companies can't hire more employees if they can't sell any more of their services or products, the economy now needs demand to create growth, the supply-side math just doesn't add up.

Others claim that getting our fiscal house in order should be our primary objective and somehow (it hasn't been explained how as far as I'm aware) this will spur hiring and economic growth. As we've learned from the lessons of Hoover and FDR cutting spending during a recession/recovery actually shrinks the economy and causes unemployment to rise.

Economic recovery is going to cost money, Presidents from both parties have invested dollars in infrastructure and other programs during recessions and we know it creates jobs and spurs economic growth. Now that doesn't mean that we can haphazardly spend, we have to target stimulus injections towards programs we know promotes growth such as those I've already listed. Anytime I bring this topic up I'm chided by my conservative friends about out-of-control spending, I don't know of a single liberal out there who thinks we should spend beyond our means for extended periods of time or during a strong economic climate. But in desperate times you sometimes have to overextend your finances to keep a bad situation from getting worse. I cannot understand in a world where it is expected that businesses and individuals will carry debt (most folks don't pay cash for their home) that somehow the government can't. Every major country in the world has debt, why would the United States by any different? Everyone agrees that we cannot sustain our current spending levels, yes even liberals, but it all comes down to priorities. Do you focus on debt now while the economy and country are hurting or do you invest in growth now and then focus on spending once the economy recovers?

In which order do you think we should address the following?

__ Getting the unemployed back to work

__ Paying down our debt

I like to think of it in terms of a household, if you're out of work do you focus on paying off your credit cards or focus on getting a new job even if it means spending money on a new suit and a resume? I think the choice is obvious, somehow Washington does not.

Wednesday, July 6, 2011

The Need To Cut Spending...Later

As deficit reduction talks continue there are rumors that spending cuts agreed to by Democrats and Republicans could exceed $1 trillion, it has been cited that this would be the largest amount of cuts on record. This number was agreed to prior to Republican Congressional leaders Eric Cantor and Jon Kyl walking away from deficit reduction talks that I wrote about in a previous post. According to recent reports there still has been no serious discussion on revenue increases in the form of closing tax loopholes and ending tax credits for those who no longer need them. As I've stated previously in multiple posts I agree that we must address spending, but now is not the time to do so. Obviously I don't expect you to just take my word for it, after all I am not an economist nor have received any education in the field beyond a few basic economics courses. I have arrived at my opinion base on what I've read and listened to from those who are economists and do have substantial education in the field of economics. What I'm more excited about is that now I actually have reports that support what I've been saying, within the past few weeks the Congressional Budget Office and the Center on Budget and Policy Priorities have both release reports warning against cutting spending while the economy is still recovering. I hereby present them to you for your consideration.

The Center on Budget and Policy Priorities released a report on June 28th warning that deeper than necessary cuts states are making harm the economic recovery and their long-term economic interests. This report also warns against cutting funds to these cash-strapped states and proposes continuing emergency Medicaid payments to states as needed. You'll notice a theme to what cuts states are making as outlined in the report, they are gutting education and Medicaid while not addressing losses in revenue.

This is a short 5-page report that is written in layman's terms, I encourage you to read it:

New Fiscal Year Brings Further Budget Cuts to Most States, Slowing Economic Recovery, Center on Budget and Policy Priorities, June 28, 2011

The Congressional Budget Office released their 2011 long-term budget outlook a few weeks ago and also warn against enacting large spending cuts while the economy is still in recovery. After stating that enacting large spending cuts now would harm economic recovery the report goes on to say "However, the sooner that medium and long-term changes to tax and spending policies are agreed on, and the sooner they are carried out once the economy recovers, the smaller will be the damage to the economy from growing federal debt" (emphasis added). So debating cuts now is recommended, but they are warning against enacting them just yet.

You can read the 4-page summary report here:

CBO's 2011 Long-Term Budget Outlook Summary, Congressional Budget Office, June 2011

If you hunger for more charts, graphs, and economic speak you can read the full 108-page report here:

CBO's 2011 Long-Term Budget Outlook, Congressional Budget Office, June 2011

I am not saying that we don't need spending cuts, as both of these reports demonstrate our current revenue and spending levels are unsustainable, but the economic recovery is delicate and enacting large spending cuts now would be devastating. I haven't heard a single member of Congress from either party say that we don't need cuts, that is an unrealistic position, but almost every single Republican member of Congress says that we shouldn't "raise taxes" which is an absolutely ridiculous position to take. First, nobody involved in the current deficit reduction debates has proposed raising taxes on anybody as far as I'm aware, what they have proposed is ending certain credits and closing tax loopholes. Closing these loopholes and ending credits isn't "raising taxes" it's reducing spending through the tax code, these types of tax benefits are spending policies and should be subjected to cuts just like any other spending. According to the Rachel Maddow Show on MSNBC Exxon Mobil makes a profit of $5 million per hour (you can see the video here along with how much they made in profit as she was speaking), do they really need their tax subsidy? Do corporations who are doing better than middle-class America really need a tax credit to buy private jets while at the same time states are slashing education and asking our seniors and the disabled to pay more for their healthcare?

Solving our long-term deficit problem will take a balanced approach to include spending cuts and revenue increases, not just one or the other. The faster our economy recovers and the faster we can get people back to work (both of which will probably require the government to temporarily spend more money) the faster we can enact deficit reducing solutions. But we need to take it one step at a time, these are completely separate issues that you can't just lump together or find a singular solution for. Step #1: Spend whatever it takes to get America back to work. That's why Republicans were given control of the House, because they campaigned on being able to create jobs better than the Democrats, it's July and there still hasn't been a jobs bill. Instead they've misread and/or used the election results as an excuse to cut Medicare, education, collective bargaining, and draft legislation that gives the government more control over your personal life.

I wanted to end with a link to a Newsweek article written by former President Bill Clinton on June 19th. In it he lists 14 ways to put America back to work and considering he oversaw the largest peacetime economic expansion in US history it might behoove members of Congress and President Obama to consider some of these ideas.

The Center on Budget and Policy Priorities released a report on June 28th warning that deeper than necessary cuts states are making harm the economic recovery and their long-term economic interests. This report also warns against cutting funds to these cash-strapped states and proposes continuing emergency Medicaid payments to states as needed. You'll notice a theme to what cuts states are making as outlined in the report, they are gutting education and Medicaid while not addressing losses in revenue.

This is a short 5-page report that is written in layman's terms, I encourage you to read it:

New Fiscal Year Brings Further Budget Cuts to Most States, Slowing Economic Recovery, Center on Budget and Policy Priorities, June 28, 2011

The Congressional Budget Office released their 2011 long-term budget outlook a few weeks ago and also warn against enacting large spending cuts while the economy is still in recovery. After stating that enacting large spending cuts now would harm economic recovery the report goes on to say "However, the sooner that medium and long-term changes to tax and spending policies are agreed on, and the sooner they are carried out once the economy recovers, the smaller will be the damage to the economy from growing federal debt" (emphasis added). So debating cuts now is recommended, but they are warning against enacting them just yet.

You can read the 4-page summary report here:

CBO's 2011 Long-Term Budget Outlook Summary, Congressional Budget Office, June 2011

If you hunger for more charts, graphs, and economic speak you can read the full 108-page report here:

CBO's 2011 Long-Term Budget Outlook, Congressional Budget Office, June 2011

I am not saying that we don't need spending cuts, as both of these reports demonstrate our current revenue and spending levels are unsustainable, but the economic recovery is delicate and enacting large spending cuts now would be devastating. I haven't heard a single member of Congress from either party say that we don't need cuts, that is an unrealistic position, but almost every single Republican member of Congress says that we shouldn't "raise taxes" which is an absolutely ridiculous position to take. First, nobody involved in the current deficit reduction debates has proposed raising taxes on anybody as far as I'm aware, what they have proposed is ending certain credits and closing tax loopholes. Closing these loopholes and ending credits isn't "raising taxes" it's reducing spending through the tax code, these types of tax benefits are spending policies and should be subjected to cuts just like any other spending. According to the Rachel Maddow Show on MSNBC Exxon Mobil makes a profit of $5 million per hour (you can see the video here along with how much they made in profit as she was speaking), do they really need their tax subsidy? Do corporations who are doing better than middle-class America really need a tax credit to buy private jets while at the same time states are slashing education and asking our seniors and the disabled to pay more for their healthcare?

Solving our long-term deficit problem will take a balanced approach to include spending cuts and revenue increases, not just one or the other. The faster our economy recovers and the faster we can get people back to work (both of which will probably require the government to temporarily spend more money) the faster we can enact deficit reducing solutions. But we need to take it one step at a time, these are completely separate issues that you can't just lump together or find a singular solution for. Step #1: Spend whatever it takes to get America back to work. That's why Republicans were given control of the House, because they campaigned on being able to create jobs better than the Democrats, it's July and there still hasn't been a jobs bill. Instead they've misread and/or used the election results as an excuse to cut Medicare, education, collective bargaining, and draft legislation that gives the government more control over your personal life.

I wanted to end with a link to a Newsweek article written by former President Bill Clinton on June 19th. In it he lists 14 ways to put America back to work and considering he oversaw the largest peacetime economic expansion in US history it might behoove members of Congress and President Obama to consider some of these ideas.

Sunday, July 3, 2011

Taxpayers Infringe Corporate Speech According To Court

On Monday the US Supreme Court ruled in favor of large anonymous campaign contributions in a 5-4 conservative majority ruling on Arizona Free Enterprise Club's Freedom Club PAC et al. v Bennett, Secretary of State of Arizona et al. This ruling essentially gives privately funded candidates greater speech over publicly funded candidates.

In 1998 the people of Arizona voted on and passed the Arizona Clean Elections Act providing candidates who opted out of private campaign financing a public grant. This Act would also provide additional grants if the candidate was outspent by a privately funded opponent to help keep a level playing field. This Act was put on the ballot in response to corrupt campaigns that had occurred previously in an attempt to make a cleaner system.

The US Supreme court has now ruled against this law, more specifically the "trigger" mechanism of the law that allows for additional grants to help keep the candidates financially even. The court is arguing that these additional grants infringed on the speech of private donors. I don't think that anybody was surprised by this ruling as the same conservative judges that brought us the Citizen's United ruling arguing that corporations were citizens and could give unlimited contributions to campaigns. We saw the effects of that ruling in this most recent election where not only can corporations, groups, and even other countries donate to political campaigns they can do so secretly through 3rd party groups (Super PAC is a term you'll hear a lot of come 2012).

Obviously the Arizona Clean Elections Act in no way, shape, or form infringes upon the speech of private donors. Nothing in the law restricts how much a privately funded candidate can raise, it just allows for a publicly funded candidate have a similar level of funds. It doesn't even provide for the publicly funded candidate to receive equivalent funding as there are restrictions as to what percentage of the public campaign finance pool can be used during an election cycle. The Act was intended to provide incentive for candidates to forgo private funds, which can be secret and unlimited, in hopes to make elections more transparent and fair.

The people of Arizona lost on Monday, they were victims of a corrupt system and were smart enough to recognize that and passed a law to help clean up elections and ensure their voices were heard instead of being drowned out by corporate dollars. But the conservative members of the Supreme Court overruled the people of Arizona and continued the work they started with Citizen's United to ensure that corporations and other interests were able to play a larger role in our elections and essentially allows them to buy and intimidate candidates and politicians. We know corporations are funding our elections, but maybe they're buying members of the Supreme Court as well, maybe we should ask Justice Thomas.

In 1998 the people of Arizona voted on and passed the Arizona Clean Elections Act providing candidates who opted out of private campaign financing a public grant. This Act would also provide additional grants if the candidate was outspent by a privately funded opponent to help keep a level playing field. This Act was put on the ballot in response to corrupt campaigns that had occurred previously in an attempt to make a cleaner system.

The US Supreme court has now ruled against this law, more specifically the "trigger" mechanism of the law that allows for additional grants to help keep the candidates financially even. The court is arguing that these additional grants infringed on the speech of private donors. I don't think that anybody was surprised by this ruling as the same conservative judges that brought us the Citizen's United ruling arguing that corporations were citizens and could give unlimited contributions to campaigns. We saw the effects of that ruling in this most recent election where not only can corporations, groups, and even other countries donate to political campaigns they can do so secretly through 3rd party groups (Super PAC is a term you'll hear a lot of come 2012).

Obviously the Arizona Clean Elections Act in no way, shape, or form infringes upon the speech of private donors. Nothing in the law restricts how much a privately funded candidate can raise, it just allows for a publicly funded candidate have a similar level of funds. It doesn't even provide for the publicly funded candidate to receive equivalent funding as there are restrictions as to what percentage of the public campaign finance pool can be used during an election cycle. The Act was intended to provide incentive for candidates to forgo private funds, which can be secret and unlimited, in hopes to make elections more transparent and fair.

The people of Arizona lost on Monday, they were victims of a corrupt system and were smart enough to recognize that and passed a law to help clean up elections and ensure their voices were heard instead of being drowned out by corporate dollars. But the conservative members of the Supreme Court overruled the people of Arizona and continued the work they started with Citizen's United to ensure that corporations and other interests were able to play a larger role in our elections and essentially allows them to buy and intimidate candidates and politicians. We know corporations are funding our elections, but maybe they're buying members of the Supreme Court as well, maybe we should ask Justice Thomas.

Friday, June 24, 2011

Why They Walked Out

The first entry I wrote on this blog after the introductory post was about the debt ceiling, in that post I mentioned that Republicans would hold a vote on raising the debt ceiling hostage in exchange for something but that ultimately they were bluffing and would vote to raise it even if Dems did nothing (you can read that post here). I still feel today as I did then that the Republicans are bluffing and that Democrats really don't have to address their demands and when the time comes that they have to vote in August enough of them will cross the aisle, and take the bullet for their party, to ensure the ceiling is raised. But in light of new events this week regarding bipartisan negotiations I felt it was important to revisit the issue and provide more insight into what Republicans really stand for.

Scheduled this week were four bipartisan negotiation sessions on the debt ceiling led by Vice President Joe Biden. Republican attendees of these negotiations included House Majority Leader Eric Cantor and Senate Minority Whip Jon Kyl who both decided to walk out of talks on Thursday. Why did they walk out of negotiations? Because Democrats wanted to propose increasing revenue in addition to spending cuts. That's right, because Democrats wanted to take a serious and balanced approach to the debt ceiling negotiations and evaluate all possible solutions Republican leaders felt that to be so unreasonable that they could no longer participate in negotiations. And this behavior continues to prove a point I make all the time, Republicans represent the wealthiest of Americans and don't care about the middle-class.

Just to be clear, raising the debt ceiling doesn't mean that we have to increase spending as it is the budget that controls spending. Raising the debt ceiling ensures that we are able to "pay our bills" to those that we have already borrowed from and to cover new borrowing that stems from budgets. Spending debates are better left for when Congress plans the next budget, but Republicans insisted that the debt ceiling vote should be used to address spending and the Democrats have capitulated. Democrats have been open to cuts proposed by the GOP in these negotiations including cuts to Medicare (provider-side cuts), cuts to the Pell Grant program, and other cuts that are tough for Democrats to swallow. But as soon as Dems propose cutting tax subsidies to Big Oil, eliminating tax loopholes for corporations who don't currently pay federal taxes, and shifting some tax subsidies that go to those making over $500,000 a year to the middle-class the Republicans walk out. Republicans want the middle-class, the elderly, and children to carry the economic burden. We've seen it in their budget proposal and bills that have been passed in the GOP led House. Not once has the GOP ever asked the wealthy and corporations to sacrifice anything this session. Not once. I've written about this before and I'm sure you've read articles about this but it's worth repeating here. CEOs and corporations are doing better now than they ever did before 2008 while the middle-class continues to struggle and all the GOP can come up with are cuts to programs working Americans, children and the elderly depend on, cuts to things that protect the middle-class and balking at any proposal that those who are doing very well pay a few percent more in taxes (or any taxes at all in some cases).

Their motive is to take care of those who fund their campaigns but they claim that they don't want to burden the "job creators." Supply-side economics (aka trickle-down economics) doesn't work, we've tried it and it costs us jobs and creates recessions. I was talking with my Dad the other day and he heard somebody explain the GOP's theory this way, and I think it's the most simplistic way this can be illustrated:

Let's say that I'm a CEO of a company that produces Widgets and last year we produced 150,000 Widgets but only sold 148,000 Widgets. I still have 2,000 Widgets sitting in my warehouse that I can't move. The economy isn't doing great and unemployment is up so the GOP gives my company (and me personally) a tax cut, not only do they give me a tax rate cut they also give my company a tax holiday reducing our tax rate to 5% for this year. Bitchin!!! I can hire a bunch of new employees to help us make more Widgets! But wait, I couldn't even sell the 150,000 Widgets we produced last year so if I hire more employees and can produce 250,000 Widgets I can still only sell 149,000. If I hired more people just because I got a tax cut my investors would hang me by my thumbs! I like my job so I'll just use the tax cut to by up more company stock and inflate the value of my company instead.

That's how supply-side economics works, you can give corporations all the tax breaks you want but without demand they're not going to produce any more than they can sell and in turn will not hire any more workers. To get the economy going you have to invest in jobs. Most Republicans know this, they oppose tax hikes on the wealthy and corporations because they fund their campaigns not because they think it will create any new jobs. But if they say that they can't get you to vote for them.

Republican leadership walked out of debt ceiling negotiations because they don't even want to hear anything about closing tax loopholes or raising taxes on the wealthy but before they left they made sure that Dems agreed to cuts that would harm middle-class Americans. Another reason they walked out was to shove the issue to Obama so that when they eventually do vote to close tax loopholes or raise taxes they can just blame it on the President and say that they had no choice because the debt ceiling had to be raised. Because as I've said before they will raise the debt ceiling but they're going to position themselves to their political advantage first.

Scheduled this week were four bipartisan negotiation sessions on the debt ceiling led by Vice President Joe Biden. Republican attendees of these negotiations included House Majority Leader Eric Cantor and Senate Minority Whip Jon Kyl who both decided to walk out of talks on Thursday. Why did they walk out of negotiations? Because Democrats wanted to propose increasing revenue in addition to spending cuts. That's right, because Democrats wanted to take a serious and balanced approach to the debt ceiling negotiations and evaluate all possible solutions Republican leaders felt that to be so unreasonable that they could no longer participate in negotiations. And this behavior continues to prove a point I make all the time, Republicans represent the wealthiest of Americans and don't care about the middle-class.

Just to be clear, raising the debt ceiling doesn't mean that we have to increase spending as it is the budget that controls spending. Raising the debt ceiling ensures that we are able to "pay our bills" to those that we have already borrowed from and to cover new borrowing that stems from budgets. Spending debates are better left for when Congress plans the next budget, but Republicans insisted that the debt ceiling vote should be used to address spending and the Democrats have capitulated. Democrats have been open to cuts proposed by the GOP in these negotiations including cuts to Medicare (provider-side cuts), cuts to the Pell Grant program, and other cuts that are tough for Democrats to swallow. But as soon as Dems propose cutting tax subsidies to Big Oil, eliminating tax loopholes for corporations who don't currently pay federal taxes, and shifting some tax subsidies that go to those making over $500,000 a year to the middle-class the Republicans walk out. Republicans want the middle-class, the elderly, and children to carry the economic burden. We've seen it in their budget proposal and bills that have been passed in the GOP led House. Not once has the GOP ever asked the wealthy and corporations to sacrifice anything this session. Not once. I've written about this before and I'm sure you've read articles about this but it's worth repeating here. CEOs and corporations are doing better now than they ever did before 2008 while the middle-class continues to struggle and all the GOP can come up with are cuts to programs working Americans, children and the elderly depend on, cuts to things that protect the middle-class and balking at any proposal that those who are doing very well pay a few percent more in taxes (or any taxes at all in some cases).

Their motive is to take care of those who fund their campaigns but they claim that they don't want to burden the "job creators." Supply-side economics (aka trickle-down economics) doesn't work, we've tried it and it costs us jobs and creates recessions. I was talking with my Dad the other day and he heard somebody explain the GOP's theory this way, and I think it's the most simplistic way this can be illustrated:

Let's say that I'm a CEO of a company that produces Widgets and last year we produced 150,000 Widgets but only sold 148,000 Widgets. I still have 2,000 Widgets sitting in my warehouse that I can't move. The economy isn't doing great and unemployment is up so the GOP gives my company (and me personally) a tax cut, not only do they give me a tax rate cut they also give my company a tax holiday reducing our tax rate to 5% for this year. Bitchin!!! I can hire a bunch of new employees to help us make more Widgets! But wait, I couldn't even sell the 150,000 Widgets we produced last year so if I hire more employees and can produce 250,000 Widgets I can still only sell 149,000. If I hired more people just because I got a tax cut my investors would hang me by my thumbs! I like my job so I'll just use the tax cut to by up more company stock and inflate the value of my company instead.

That's how supply-side economics works, you can give corporations all the tax breaks you want but without demand they're not going to produce any more than they can sell and in turn will not hire any more workers. To get the economy going you have to invest in jobs. Most Republicans know this, they oppose tax hikes on the wealthy and corporations because they fund their campaigns not because they think it will create any new jobs. But if they say that they can't get you to vote for them.

Republican leadership walked out of debt ceiling negotiations because they don't even want to hear anything about closing tax loopholes or raising taxes on the wealthy but before they left they made sure that Dems agreed to cuts that would harm middle-class Americans. Another reason they walked out was to shove the issue to Obama so that when they eventually do vote to close tax loopholes or raise taxes they can just blame it on the President and say that they had no choice because the debt ceiling had to be raised. Because as I've said before they will raise the debt ceiling but they're going to position themselves to their political advantage first.

Wednesday, June 22, 2011

Upholding The War Powers Act

I've been putting off writing a blog entry on this topic for a week or so now, partially because I've been busy but primarily because I hoped there would be some new development regarding Libya making what follows irrelevant. But as you probably are aware we have passed the 90-day mark for our operation in Libya and are continuing operations even though the War Powers Act requires that all actions cease after 90 days if there is no authorization from Congress.

The War Powers Act was passed by Congress in 1973 in an effort to check presidential powers after US commitment to armed conflict is undertaken without congressional authorization. It requires the President to notify Congress of committing US forces within 48 hours and allows operations to continue without approval from Congress for 60 days, beyond which an additional 30 days are allowed for withdrawal. The 90 day period from when we began action in Libya expired on the 20th. The President has expressed that the War Powers Act is a valid law, unlike some previous presidents who have questioned its constitutionality, but he claims that US involvement in Libya is exempt from the War Powers Act as it is a NATO mission. Although Mr. Obama isn't the first President to push the limits of the War Powers Act I am not aware of any administration continuing action beyond the 90-day period without congressional approval.

I am supportive of our efforts in Libya and I believe that President Obama did the right thing by using US resources in helping stop what would have been mass genocide. I can also understand the point that the President is making by claiming that NATO operations are exempt from the War Powers Act but I disagree with this assessment. There are certain obligations of NATO members when another member of NATO is the victim of hostilities but Libya is not a part of NATO and actions within that country certainly do not directly and immediately threaten our NATO allies. Even if another NATO member was the victim of hostilities I believe that as a nation we have a right to determine the extent of our involvement through Congress not by unilateral action of a President. Although NATO requires support in those types of situations it does not require military assistance. There are times when the President must act unilaterally due to time constraints, in today's world violence can flare-up with little notice and waiting on approval from Congress could cost lives, but there must be limits and conditions to that power and that's exactly what the War Powers Act was intended for.

Although I feel that President Obama is wrong on continuing action without congressional approval the blame is not his alone, Congress has failed to meet its obligation to check presidential power. Nowhere in the War Powers Act does it require Congress to wait for the President to do anything before they vote to continue or cease military involvement. The President is only required to brief Congress and even if the President fails to do this Congress can still act. There are some who have claimed that the President has failed to inform Congress of his actions, this is false, the administration has had continuous briefings with Congress to keep them informed of operations. And to be fair there have been members of Congress who have proposed bills dealing with Libya, but these have failed to pass as they do not have support from congressional leadership from either side of the aisle.