Okay so its been a little over a month since I've posted anything, chalk it up to a busy work schedule combined with some writer's block. The only thing that seems worth writing about politically recently has been revolving around the debt ceiling and the economy and I've been pretty bored (although still aggravated) with that topic. As you know Congress has recently passed a debt reduction package that only contains spending cuts, to the chagrin of liberals, and in turn raises the debt ceiling, to the disfavor of the Tea Party. Standard & Poor's downgraded the creditworthiness of the United States for the first time in American history on Friday from AAA to AA+. The downgrade was strictly political pointing out that some in Congress were ready and willing to take the US to the brink of default and that Republicans were unwilling to increase revenues even if that meant only cutting tax loopholes while not raising tax rates (not sure why they waited until after the deal was done to downgrade). Republicans in Congress and those seeking the GOP nomination for a run at the White House have ignored that little factoid while placing all of the blame on the President. Although S&P is correct in their statements about our current political turmoil they were wrong for downgrading our creditworthiness as there is no current risk of us not honoring our debts. In fact investors flocked to US Treasury notes on Monday, ignoring S&P's downgrade and proving that the US is the safest investment in the world, all while the Dow plunged 634 points in response to investor's concerns that the economy is not growing as fast as needed. Washington has spent the past few months focusing on the wrong problems, deficit and our long-term debt, and what they should be focusing on is economic growth and investors agree which is why the Dow had fallen by 15% over the past two weeks. What we need now is a stimulus.

Moving in the Wrong Direction; a Brief History Lesson

We're making the same mistakes some previous administrations had made during times of recession and depression which lengthened the time that many had to endure economic suffering. I'm reminded of the often misquoted and misattributed statement of George Santayana who said "those who cannot remember the past are condemned to repeat it." While there has been an influx of freshmen members of congress who claim to know more of American history than the average American they clearly did not study the economics of recession. After the stock market crash of 1929 that led to the Great Depression President Herbert Hoover chose to focus on balancing the budget (having already created deficits in part by reducing the top tax rate from 73% to 24% prior to the crash), rejecting the idea of federal relief payments to individuals, and passing legislation to expel immigrants from Mexico back to their home country. These are many of the same ideas being proposed today; lower taxes on the wealthiest and corporations, reduce unemployment insurance benefits, entitlements, and other government assistance programs, and increase the deportation of illegal immigrants with tougher anti-immigration measures. As we now know none of Hoover's initiatives led to economic recovery and only worsened a bad situation.

When Franklin D. Roosevelt took office in 1933 he immediately went to work on initiatives to grow the economy. The creation of the Civilian Conservation Corps allowed the government to directly hire 250,000 men to work on rural projects, he implemented mortgage relief to stop many foreclosures and keep people in their homes (although President Hoover also enacted a mortgage relief policy it was too little and too late into his presidency to make any significant impact). FDR enacted tougher regulations on business while also encouraging unions and creation of the Securities Exchange Commission, the Tennessee Valley Authority (infrastructure projects), and Social Security. He injected billions of dollars into the economy as stimulus and while Hoover grew the debt from 16% of the gross national product (GNP) to 40% the debt held steady under FDR until the start of WWII, but he still was blamed for the height debt by conservative opponents (sound familiar?). Unemployment fell at a steady rate during this period and the economy grew rapidly until 1937.

Enter 1937, company profits were at the levels they were in 1929 and unemployment, while high, was declining (remember company profits now are better than they were in 2008 and unemployment is slowly declining) and the FDR administration felt pressured into addressing the debt and deficit. In response government spending was reduced and the economy dipped into a 13 month recession with unemployment rising by over 4% and manufacturing output declined by 37%

There should be a lesson to be learned from this, worrying about debt and deficits during a recession and responding by tightening the government's belt leads to an extended recession or a decline back into a recession during a recovery. What grew the economy during the 1930's and other times in our history was economic stimulus and investments in pro-growth agendas. President Bush lowered taxes on the wealthiest of Americans prior to our recession that started in 2008 (just like Hoover did before the depression) and President Obama has chosen to listen to conservatives and extend these tax cuts, keeping money from the government that could be used to stimulate our economy and address our deficits. And now the President has agreed to reign in government spending by reducing proposed spending in the FY 2011 budget and a cuts-only agreement to address our nation's debt during a time of slow economic recovery. I don't feel that enacting the same policies that led to recessions in the past will somehow not have the same results now.

A Road to Recovery

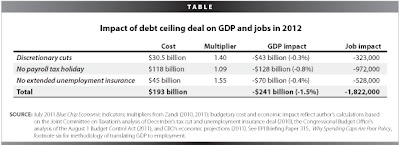

The first item on the agenda is to extend unemployment benefits, current policies that extend federal unemployment benefits are set to expire at the end of 2011, we can't let these expire. Unfortunately there are some that demonize the unemployed, many of those who are currently collecting unemployment insurance are only unemployed as a result of the recession. Prior to our current economic situation many of these individuals held stable, well-paying jobs, and have been actively seeking employment. Companies like McDonald's aren't going to take a chance on an unemployed high-level corporate manager who used to make six figures knowing that they will take a better job in their previous field as soon as one becomes available. According to the Joint Committee on Taxation not extending unemployment benefits would cost 528,000 jobs and shrink the GDP by 0.4% in 2012 (see Table 1). Unemployment provides a safety net for families so that they can continue to buy food, pay their bills, and stay in their home while the wage earner(s) are looking for employment.

Next we need to extend the payroll tax holiday that is also set to expire at the end of this year. I was initially against the payroll tax holiday, and still am, as I feel it was a ploy to underfund Social Security which currently does not contribute to our debt and felt that it was a slippery slope. Once payroll taxes were lowered what politician in their right mind would ever raise them back to their normal rates? But now that payroll taxes have been lowered allowing the holiday to expire would essentially raise taxes on the middle class who are already suffering, prompting them to spend less and we just cant afford to take dollars out of the economy right now. According to the Joint Committee on Taxation not extending the payroll tax holiday would cost 972,000 jobs and shrink the GDP by 0.8% in 2012 (see Table 1).

If you combine not extending unemployment and the payroll tax holiday with the jobs that will be lost due to spending cuts proposed by the debt reduction deal the economy will lose over 1.8 million jobs in 2012 along with shrinking the GDP by 1.5% (see Table 1). This is not a formula for recovery.

Table 1.

We also must invest in education, the current trend among states and the federal government has been to slash funding for education. I'm speaking of both primary and secondary education. We must invest in our children to ensure that we remain competitive on the world stage and to have a workforce who posses the skills needed for the 21st century and beyond. There are a lot of those unemployed I mentioned earlier whose jobs will never return, either their employer learned to do more with less or their job was shipped overseas with wages so low the United States cannot compete. We must invest in education for the unemployed as well to provide them with the tools needed to transition to a new career. Eric Spiegel, CEO for Siemens in the US has expressed that they have jobs that need to be filled but the pool of unemployed lack the skills necessary for those job openings (read the CNBC story here).

And finally we need to invest in job-creation projects and I feel the most effective way the government can directly create jobs is through infrastructure projects. In 2009 the American Society of Civil Engineers released their Report Card for American Infrastructure giving the US an overall rating of "D" and estimating it would cost $2.2 trillion over 5 years to fix our deficiencies. We know we have to fix our infrastructure, not doing so is just delaying the inevitable. The government will have to spend money at some point to fix our infrastructure and there's no better time than now. It's the perfect storm, you have an unemployment rate of 9.1%, construction companies, manufactures, and contractors are desperate for work. The US government will not be able to get work contracts any cheaper than they can right now, if we wait until the economy is stronger to invest in infrastructure the price will just go up, labor, materials, and overhead will all cost more in a stronger economy. Not only will the government get cheaper contracts now rather than later it will create direct jobs for those who will be working on these projects, these construction and manufacturing jobs will in turn create retail and service jobs, adding more taxpayers to the pool which in turn could be used to address our debt once the economy recovers. It's a win-win.

We can roll all of these initiatives into a stimulus package that will guarantee economic growth at a much faster pace than we are experiencing now. I know that "stimulus" has become a bad word in our lexicon and many have said that the stimulus "failed" and didn't save or create any jobs. This is just not true, if anything the stimulus wasn't big enough and was more of a band-aid approach. The stimulus provided money to states who were out of money to prevent massive layoffs in the public sector, had the stimulus not been passed millions of teachers, firefighters, police officers, and other public sector workers would have been out of work which would have increased unemployment to even higher rates than we are currently experiencing and would have led to more job losses in the private sector as spending would have decreased. Had more money been allotted for the stimulus not only could it have saved the jobs it did there would have been more money available to invest in projects that would have created new jobs (some states were able to invest in infrastructure projects that did lead to job creation). According to FactCheck.org (using numbers from the Congressional Budget Office) the stimulus created and saved between 1.4 million and 3.3 million jobs and reduced unemployment between 0.7 and 1.8 percentage points. The band-aid stimulus has since expired, now it's time to enact the pro-growth stimulus including items listed above.

A Choice

Some claim that just reducing taxes on corporations and the wealthy along with spending cuts will spur job growth, it doesn't. We've tried supply-side economics in the past and it doesn't lead to job creation. The Bush tax cuts were in place for 10 years without any significant job growth, we have since extended the cuts and have not seen a sudden jump in job growth that currently isn't keeping pace with population growth. Companies can't hire more employees if they can't sell any more of their services or products, the economy now needs demand to create growth, the supply-side math just doesn't add up.

Others claim that getting our fiscal house in order should be our primary objective and somehow (it hasn't been explained how as far as I'm aware) this will spur hiring and economic growth. As we've learned from the lessons of Hoover and FDR cutting spending during a recession/recovery actually shrinks the economy and causes unemployment to rise.

Economic recovery is going to cost money, Presidents from both parties have invested dollars in infrastructure and other programs during recessions and we know it creates jobs and spurs economic growth. Now that doesn't mean that we can haphazardly spend, we have to target stimulus injections towards programs we know promotes growth such as those I've already listed. Anytime I bring this topic up I'm chided by my conservative friends about out-of-control spending, I don't know of a single liberal out there who thinks we should spend beyond our means for extended periods of time or during a strong economic climate. But in desperate times you sometimes have to overextend your finances to keep a bad situation from getting worse. I cannot understand in a world where it is expected that businesses and individuals will carry debt (most folks don't pay cash for their home) that somehow the government can't. Every major country in the world has debt, why would the United States by any different? Everyone agrees that we cannot sustain our current spending levels, yes even liberals, but it all comes down to priorities. Do you focus on debt now while the economy and country are hurting or do you invest in growth now and then focus on spending once the economy recovers?

In which order do you think we should address the following?

__ Getting the unemployed back to work

__ Paying down our debt

I like to think of it in terms of a household, if you're out of work do you focus on paying off your credit cards or focus on getting a new job even if it means spending money on a new suit and a resume? I think the choice is obvious, somehow Washington does not.

No comments:

Post a Comment